I got a call before the holidays from a prospective customer that I introduced to one of my portfolio companies. He said he loved our product, saw it fitting in perfectly into their platform, but that we were not responsive enough to their needs. I was able to get a second chance for our team but since deals are momentum-based, I knew that it would be an uphill struggle to win. While our technology was the best, his guys told him that they were quite concerned about our ability to be there when the shit hit the fan. In other words, they wanted to make sure that no matter what happened that they could rely on us to be there on a moment’s notice to support them and help fix any issues. As I have mentioned in a previous post, you only get one chance to make a first impression and if you are strapped too thin or chasing too many deals at once, it may come back to haunt you. You see, many companies that try to partner or sell into enterprises forget that showing the love early in the sales process and stressing the support factor is as big a deal as the technology itself. I am not saying that if your technology sucks and you are there 24/7 you will win, but what I am saying is that if your technology is on the margin and all things being equal, your ability to support that partner or customer will be a huge deciding factor. So if you want the customer to show you the money, make sure that you show the love pre- and post sale.

Category: Entrepreneurship

Google giveth…and Google taketh away…

Here is another example of one of my portfolio companies’ mantras: Google giveth and Google taketh away (see my post from April for more on this). Who knows the real reason why Google shut off Adsense for Incredimail (Nasdaq: MAIL) but look at what happened to the stock in one day—a 40% drop. I am not saying that startups should not use Adsense but this just reminds that one should always take a hard look at their business and if they are too heavily dependent on any one customer or partner, they should think long and hard about how to diversify their business. Any good company will ride the gravy train as long as they can while preparing themselves for the day the ride will be over. As I have said before, there is nothing wrong with free distribution or easy revenue but at some point in time, startups need to figure out how to control their own destiny.

And while we would all love to build our business off the back’s of other brands and distribution, at the end of the day, in order to create a big winner, it is imperative for startups to control their own destiny. This means that your business has to be able to grow organically and not have its fate FULLY dependent on its partners.

Anyway, Michael Eisenberg also has a nice take on this subject over at Seeking Alpha.

Newsgator – going about enterprise sales the right way

I was catching up on my feed reader this morning and noticed my friend Jeff Nolan’s post (also see Brad Feld) on Newsgator and FeedDemon RSS clients now being free. I know that Jeff joined Newsgator because of his belief in the enterprise, and I applaud the company’s new strategy. As I have written before, enterprise sales is incredibly hard. If I were going to do anything on the enterprise side, I would look at how to make my sales as frictionless as possible. Leverage SAAS and downloads and reduce the barriers to usage. What you have in a free Newsgator and FeedDemon RSS client is the opportunity for the pull-push method of enterprise selling vs. the push-pull method. Rather than only rely on expensive enterprise sales guys trying to push products into corporations, Newsgator, as Jeff says in his blog post, has the opportunity to expand its client base from 1mm users to 10mm users and have them potentially pull Newsgator into new enterprise sales opportunities. This is certainly a new way of thinking and considering that the company has an excellent client, this should be a winning strategy. From Jeff’s post:

So if we are generating zero dollars of revenue from the client applications that we used to sell, well what is our business? Today we generate the bulk of our revenue from enterprise software, which is predominately server products but also includes these client applications (we call them “endpoints”). The fact remains that we actually generate a significant number of enterprise leads from people who are using our client apps and then realize they would benefit from enterprise management products. By that logic, more client applications in use is more enterprise goodness for us.

The KISS Method and innovation

Keep reading this clip and article for more on Evan’s thoughts – focusing on simplicity and radical constraints

|

Changing leadership is never easy

it is never easy whether it be in business or sports but the comment that stands out most for me is that bringing in an Offensive Coordinator for Coach Billick would have been a band-aid. Companies and teams don’t need band-aids-they need to make the tough decisions. So if you think your company needs a COO, think deeply about whether or not that is what you need or if you really need a new CEO

|

Don't forget the long term

Tis the holiday season and with the end of year comes budget planning for 2008. So that means it is time to get all of your key management members together to start reviewing 2007, what worked well, what did not work out, and to hammer out goals for next year. In the spirit of giving, I thought I would share with you one piece of advice – don’t sacrifice the long term value of your business for the short term. What it comes down to is how you allocate your dollars in your budget. Every dollar you spend in one functional area is a dollar taken away from another department. If you spend too much on sales today, you may not have enough in R&D and vice versa. It is careful when budgeting to think about 2008 but also to plant the seeds for 2009 as well.

Let me give you a few examples from recent meetings with portfolio companies or friends seeking advice. I was recently reviewing a 2008 budget and was quite excited about the bookings and revenue ramp that the management team had presented. However, as I dug into the model the one point I recognized was that it was all driven by additional sales headcount. That is ok, but what I did not see was any investment in building out our channel or OEM business. Granted, the management had to finely balance their cash spending with their revenue forecast, but my concern was that if we did not invest today to build for the future 12 months out, we would not have any sales leverage in our business. After discussion, we were in favor of sacrificing some near term revenue in order to get the key headcount to start building the channel and partnership model. Yes, these opportunities always take time to build, but if done right can help fuel rapid sales growth 12-18 months down the line. Without any upfront investment, the company was stuck with a 1:1 sales model meaning that bookings and revenue were directly correlated to each additional headcount.

Another example came from a breakfast meeting I had today. I was catching up with an entrepreneur I have known for awhile and getting an update on his business. We were discussing the various product lines at the company, and how each line was respectively performing. What was clear was that the market the company initially set out to conquer had become commoditized, and that his business did not diversify quickly enough to offset this trend. In other words, he said that while the company was doing well, his biggest regret was not investing enough in the future. Even though they saw their core market slowly dying, they milked the cash cow as much as they could but did not do enough to build new product lines. It was a classic case of "the exit is around the corner" where the management and board focused too much on prettying up the revenue growth and profitability lines at the expense of positioning the company solidly for the future. When the exits didn’t materialize, the team had to go back to the drawing board and start building out a new product line. If they had done that 2 years ago, they may have sacrificed some revenue but they would also be better positioned today.

So the lesson is both cases is to carefully balance your revenue goals with making the right level of investment for the future whether it be in diversifying your go-to-market strategy or building out a new product line. Yes, we live in a short-term world where every investor is focused on the next month or quarter, but it is imperative for any technology company to balance today’s needs with the future opportunity. I hope these examples spur some vibrant discussion amongst your management team as you put together your goals for 2008 while keeping an eye out for 2009.

It's hard to sell scalability

I have written many recent posts on Internet and web-based models, but I still do spend a good portion of my time with companies selling in the enterprise. After a series of meetings over the last few days with startups and some of my portfolio companies, I wanted to highlight one important fact – it is hard to sell scalability. In addition, it is important to highlight that you only have one chance to make a first impression. So what the hell does all of this mean ?

Every interaction with your sales prospect or customer is a chance to impress. What that means is if your user interface is weak or if your product is hard to install or if during a POC process it takes you 3 days to get set up while it takes a few hours for your competitor, you have most likely lost the sale. If your product is hard to use or set up, then how is the customer going to believe that your product is more scalable? So take a word of advice, the companies that tend to do well are the ones that have nailed down the first impression – strong and clear value propostiion, great UI, and easy to use and install. Leading with scalability is a losing proposition. If someone offered you the opportunity to buy a Ferrari or a Ford Pinto at a similar price, I am sure most people would opt for the Ferrari. If I told you later on that the Ferrari had a Ford Pinto engine and the Ford Pinto had a Ferrari engine, I would imagine that most would still go for the looks and the Ferrari. For many buyers in the IT space, first impressions mean a lot and once a sales prospect falls in love with the Ferrari, it will be hard to keep pounding the table saying that your Ford Pinto will outperform the Ferrari by an order of magnitude. Many times by then you have probably lost the sale. I am not saying that scalability doesn’t matter because it does. Every customer expects you to scale and every competitor will say they scale. My only point is that if you can scale like no tomorrow but what the customer sees and touches is subpar, you are going to have a hard time generating sales.

One final point-having awesome sales engineers is key to success for any company selling in the enterprise. These positions are hard to fill as you are typically looking for someone who is not only technically savvy but also strong in sales as well. Great SEs help you close sales, make the sales prospect feel comfortable, work out the initial kinks in your technology, and provide great product feedback for your roadmap.

UPDATE: I got a few emails from readers who thought that I meant scale doesn’t matter. It does, just not as the lead-in for why your product is better than your competitor. It is hard to see, touch, or feel scale in a sales meeting and what you are left to do is make sure that every sales prospect engages with you in a proof of concept so you can demonstrate scale. And yes, if you can’t install it easily and if the customer can’t use it easily, then scale does not matter. You have to show them how your product solves their problem and why it is easy to use. Sometimes engineers can spend too much time on having the fastest engine and not enough time on designing a beautiful body. Scale matters but not as your main selling point.

NYC 2.0 (continued)

I never made it to the Web 2.0 conference yesterday, and you know how I feel about that label :-). Anyway, I happened to be in San Francisco for a portfolio company board meeting and some other events. After a Nokia boat cruise with many of the team that launched the awesome Nokia Internet 810 tablet (I will get myself one of those), I had the opportunity to go to a MySpace party to celebrate the opening of their San Francisco office. I had a great time and while I ran into many friends from the Bay Area, what I enjoyed most was bumping into many of the original New York entrepreneurs that I have known over the last 10 years. In a scary way, it felt like it was 1997 all over again, and we were at a networking event in New York talking about their first startups. The only difference is that it is 10 years later, and we have greyer hair. Jeff Stewart who was part of the Proxicom rollup and founded Mimeo and now Monitor110, said that everywhere he turned he ran into another New York entrepreneur. Standing next to me was Andrew Erlichson founder of Flashbase (sold to Doubleclick) who I funded years ago and now CEO of Phanfare, across the room was Andrew Weinreich of sixdegrees and now meetmoi, and on the other side of the room was Jason Calacanis of the Silicon Alley Reporter and Weblogs and now Mahalo. While he is in LA now, I still count him as an original New York entrepreneur. Jeff and i tried to organize a group picture but just could not make it happen.

You may be thinking to yourself who cares or why is Ed namedropping? There is a simple answer – I have known many of these guys for the last dozen or so years since the first Internet wave, and it is simply awesome to see everyone still plugging away, following their passions, getting smarter and better, and continuing to build the New York entrepreneurial ecosystem. I know we are no Silicon Valley, but it is great to see these entrepreneurs all working on their second and third companies. It was also great to hear their stories of raising their first or second or third rounds of capital for their most recent companies. When I started as a VC in 1996 and first met many of these entrepreneurs, it was clear that we were all starting from scratch. We didn’t know what we didn’t know. We didn’t have entrepreneurs working on their second and third startups back then. What we had was energy and passion. And yes I agree that the whole Silicon Alley movement was pure hype and ridiculous but for those of us who have stuck around we have learned a lot and we are on the cusp of doing some great things. We now have energy, passion, and grey hair which is a great combination. I said it before in my NYC 2.0 pitch a couple years ago, but I believe that everyday our world here is getting more and more important as the media companies and advertisers try to make sense of this new era of communications. As companies like Google and AOL and others continue to build a bigger and stronger presence here, it will continue to make us better. True to form, I have already seen my first couple of spinouts from the Google New York office, and I expect to see many more. But it is many of these guys that I hung out with above who were some of the original pioneers in New York that have helped blaze a path for many of the new entrepreneurs we are seeing today. When the bubble popped, they didn’t quit and go home. They continued to fight and continued to build new companies and for that we should all be thankful because today the New York ecosystem is building and getting stronger. The funny part is that it took me being 3000 miles from home to have this revelation again.

Are there enough ad dollars for the thousands of small startups?

|

Should I flip or should I build?

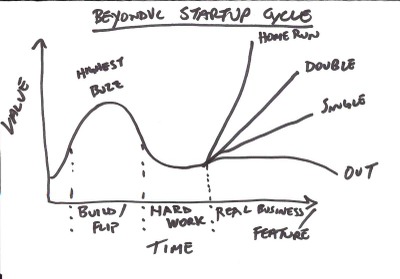

It seems that everyday there is a new annoucement of a tiny startup being bought by a large company. Two days ago it was Jaiku being bought by Google and this morning CBS announced that it is buying Dotspotter, a 10 month old gossip blog. Put yourself in these entrepreneurs’ shoes – you launch a great product or service today, usage is growing, revenue is nil or minimal, and cocktail party chatter and buzz are at its highest. You then have the opportunity to sell today at a pretty good number but you forego your chance of building that huge business. What do you do and how should you think about it? As i started thinking deeper about this question, I was reminded of the old Gartner Hype Cycle chart. If we use this as a backdrop, perhaps I could show a framework from which to think about this important decison.

According to Gartner, "A Hype Cycle is a graphical representation of the maturity, adoption and business application of specific technologies." Similarly, I have graphically represented the choices an entrepreneur has to make in the continuing saga of build or flip. Let’s call this the "BeyondVC Startup Cycle." According to Gartner, there are 5 phases in a Hype Cycle (my comments in parentheses): Technology Trigger (product launch), Peak of Inflated Expectations (height of buzz), Trough of Disillusionment (this is harder than I thought), Slope of Enlightenment (the broad market is finally ready), and Plateau of Productivity (better have my next product ready). I believe the descriptions speak for themselves as what usually happens with the adoption of new technology is that the hype builds quickly but it actually takes a lot longer to reach critical mass. Similarly, one can superimpose a startup lifecycle on the graph. If you look at the build or flip question in this context, it is obvious that an easier, less risky choice to make is best done at the Peak of Inflated Expectations or height of the cocktail circuit chatter. Usually at this point in time, an entrepreneur can maximize short-term value as acquirers will buy more on vision and technology than on business fundamentals. If you decide to build for the long haul and go for the home run, it will take you a fair amount of effort and time to create the same value that acquirers will pay today at the buzz cycle as they will expect more mature companies to have more established products or services and more milestones hit. Companies that sell at the early stages should understand that while they may forego going big, if they do not sell today for strategic value then they would have to live up to their hype and be bought in the future for real revenue. In other words, as companies mature the valuation of a startup turns from pure strategic value to one where it is based more on actual revenue multiples and market comparable data.

According to Gartner, there are 5 phases in a Hype Cycle (my comments in parentheses): Technology Trigger (product launch), Peak of Inflated Expectations (height of buzz), Trough of Disillusionment (this is harder than I thought), Slope of Enlightenment (the broad market is finally ready), and Plateau of Productivity (better have my next product ready). I believe the descriptions speak for themselves as what usually happens with the adoption of new technology is that the hype builds quickly but it actually takes a lot longer to reach critical mass. Similarly, one can superimpose a startup lifecycle on the graph. If you look at the build or flip question in this context, it is obvious that an easier, less risky choice to make is best done at the Peak of Inflated Expectations or height of the cocktail circuit chatter. Usually at this point in time, an entrepreneur can maximize short-term value as acquirers will buy more on vision and technology than on business fundamentals. If you decide to build for the long haul and go for the home run, it will take you a fair amount of effort and time to create the same value that acquirers will pay today at the buzz cycle as they will expect more mature companies to have more established products or services and more milestones hit. Companies that sell at the early stages should understand that while they may forego going big, if they do not sell today for strategic value then they would have to live up to their hype and be bought in the future for real revenue. In other words, as companies mature the valuation of a startup turns from pure strategic value to one where it is based more on actual revenue multiples and market comparable data.

At this inflection point, an entrepreneur needs to think about whether they want to and can build for the long haul (taking into account the risk and time to do so) or sell today (net present value of your potential expected outcomes in the future). This is the point where you have built a nice service or product, gotten a number of users, but have not really monetized it or created a scalable business model that can drive profits. Can you really build a company or is this just a feature for a bigger player? If you choose to go for it and raise VC funding, you have to really believe that the capital you raise will help you create a much larger pie in the end. Do you want a larger percentage of a smaller pie or a smaller percentage of a much larger one? Once you take in the money, it requires a ton of hard work to build a team, continue to innovate, and refine your business model. There are no guarantees and given the amount of time and energy you expend you could just as easily go out of business after 5 years of effort. One other factor for entrepreneurs to look at is the opportunity cost or the time you spend on one venture.

Since I never like to make decisions in a vacuum, if I had an offer, I would test the market to get a read from VCs to see what their interest level is in funding my business and also poke around and speak to a couple of other strategics to see if I could extract more value. In the end, these valuable data points will help you make a more confident decision – if no VCs bite, then it is an easy decision for you. If some VCs have an interest, try to understand how much capital and at what price they would be willing to invest. If you really believe in your business then you should either take the money from the VC or get a significant premium from the strategic investor to sell today versus building your business for the longer term.

At the end of the day, it comes down to two things. First, what is your appetite for calculated risk – in finance there is a direct correlation to risk and reward. If you want the big payday, you are not going to get it investing in risk-free bonds. Secondly, it comes down to your passion. Building a company is about more than just the money as money can be fleeting – remember the bubble, it sent a lot of carpetbaggers home. The ones who have made the big payday have focused on a broader and bigger goal, building an insanely great product or service for their customers and keeping them incredibly happy. As you do the right thing for your customers, you will do right for your investors, your employees, and ultimately yourself.