It seems that everyday there is a new annoucement of a tiny startup being bought by a large company. Two days ago it was Jaiku being bought by Google and this morning CBS announced that it is buying Dotspotter, a 10 month old gossip blog. Put yourself in these entrepreneurs’ shoes – you launch a great product or service today, usage is growing, revenue is nil or minimal, and cocktail party chatter and buzz are at its highest. You then have the opportunity to sell today at a pretty good number but you forego your chance of building that huge business. What do you do and how should you think about it? As i started thinking deeper about this question, I was reminded of the old Gartner Hype Cycle chart. If we use this as a backdrop, perhaps I could show a framework from which to think about this important decison.

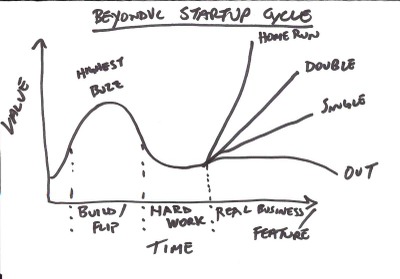

According to Gartner, "A Hype Cycle is a graphical representation of the maturity, adoption and business application of specific technologies." Similarly, I have graphically represented the choices an entrepreneur has to make in the continuing saga of build or flip. Let’s call this the "BeyondVC Startup Cycle." According to Gartner, there are 5 phases in a Hype Cycle (my comments in parentheses): Technology Trigger (product launch), Peak of Inflated Expectations (height of buzz), Trough of Disillusionment (this is harder than I thought), Slope of Enlightenment (the broad market is finally ready), and Plateau of Productivity (better have my next product ready). I believe the descriptions speak for themselves as what usually happens with the adoption of new technology is that the hype builds quickly but it actually takes a lot longer to reach critical mass. Similarly, one can superimpose a startup lifecycle on the graph. If you look at the build or flip question in this context, it is obvious that an easier, less risky choice to make is best done at the Peak of Inflated Expectations or height of the cocktail circuit chatter. Usually at this point in time, an entrepreneur can maximize short-term value as acquirers will buy more on vision and technology than on business fundamentals. If you decide to build for the long haul and go for the home run, it will take you a fair amount of effort and time to create the same value that acquirers will pay today at the buzz cycle as they will expect more mature companies to have more established products or services and more milestones hit. Companies that sell at the early stages should understand that while they may forego going big, if they do not sell today for strategic value then they would have to live up to their hype and be bought in the future for real revenue. In other words, as companies mature the valuation of a startup turns from pure strategic value to one where it is based more on actual revenue multiples and market comparable data.

According to Gartner, there are 5 phases in a Hype Cycle (my comments in parentheses): Technology Trigger (product launch), Peak of Inflated Expectations (height of buzz), Trough of Disillusionment (this is harder than I thought), Slope of Enlightenment (the broad market is finally ready), and Plateau of Productivity (better have my next product ready). I believe the descriptions speak for themselves as what usually happens with the adoption of new technology is that the hype builds quickly but it actually takes a lot longer to reach critical mass. Similarly, one can superimpose a startup lifecycle on the graph. If you look at the build or flip question in this context, it is obvious that an easier, less risky choice to make is best done at the Peak of Inflated Expectations or height of the cocktail circuit chatter. Usually at this point in time, an entrepreneur can maximize short-term value as acquirers will buy more on vision and technology than on business fundamentals. If you decide to build for the long haul and go for the home run, it will take you a fair amount of effort and time to create the same value that acquirers will pay today at the buzz cycle as they will expect more mature companies to have more established products or services and more milestones hit. Companies that sell at the early stages should understand that while they may forego going big, if they do not sell today for strategic value then they would have to live up to their hype and be bought in the future for real revenue. In other words, as companies mature the valuation of a startup turns from pure strategic value to one where it is based more on actual revenue multiples and market comparable data.

At this inflection point, an entrepreneur needs to think about whether they want to and can build for the long haul (taking into account the risk and time to do so) or sell today (net present value of your potential expected outcomes in the future). This is the point where you have built a nice service or product, gotten a number of users, but have not really monetized it or created a scalable business model that can drive profits. Can you really build a company or is this just a feature for a bigger player? If you choose to go for it and raise VC funding, you have to really believe that the capital you raise will help you create a much larger pie in the end. Do you want a larger percentage of a smaller pie or a smaller percentage of a much larger one? Once you take in the money, it requires a ton of hard work to build a team, continue to innovate, and refine your business model. There are no guarantees and given the amount of time and energy you expend you could just as easily go out of business after 5 years of effort. One other factor for entrepreneurs to look at is the opportunity cost or the time you spend on one venture.

Since I never like to make decisions in a vacuum, if I had an offer, I would test the market to get a read from VCs to see what their interest level is in funding my business and also poke around and speak to a couple of other strategics to see if I could extract more value. In the end, these valuable data points will help you make a more confident decision – if no VCs bite, then it is an easy decision for you. If some VCs have an interest, try to understand how much capital and at what price they would be willing to invest. If you really believe in your business then you should either take the money from the VC or get a significant premium from the strategic investor to sell today versus building your business for the longer term.

At the end of the day, it comes down to two things. First, what is your appetite for calculated risk – in finance there is a direct correlation to risk and reward. If you want the big payday, you are not going to get it investing in risk-free bonds. Secondly, it comes down to your passion. Building a company is about more than just the money as money can be fleeting – remember the bubble, it sent a lot of carpetbaggers home. The ones who have made the big payday have focused on a broader and bigger goal, building an insanely great product or service for their customers and keeping them incredibly happy. As you do the right thing for your customers, you will do right for your investors, your employees, and ultimately yourself.

Wow, Seth Godin just read your post, and he’s already spun it up into a whole book 🙂

http://sethgodin.typepad.com/the_dip/

The best solution is to sell part of your company if you can and hold the rest. Case in point, RightMedia sold about 20% of the company to Yahoo then six months later sold the rest of the company for several times the valuation.

If you can get big media to stick their teeth in without eating you up whole thats the best solution. Raise your valuation, get deep pockets, build more, then sell or hold but you always have the deep pockets behind you.

If you don’t have that option …

If you are a single product site, sell it. If you have a community of active and engaged users, look at your marketing metrics. Compare you’re potential audience to your current audience and growth rate. If you feel there is more pop then hold a few more months , if not sell.

Rarely in todays Internet, is it worth holding for long term, IPO’s are fairly scarce and it is very easy to copycat a good idea.

The real question is regarding the financial status of the entrepreneur:

If you’re not wealthy now, and this is your chance, then sell. You’ll feel very stupid if you didn’t take the money and later your company tanks (I know, I’ve been there).

On the other hand, if selling out now won’t affect your financial situation in a significant manner, or in other words, your financial future is guaranteed already and you’re doing this for fun more than for profit, then there’s no reason not to stick with it for the long haul.

I enjoyed reading your post, I would like to exchange a link. Additionally I would like to begin a survey for VC Bloggers on various topics would you be interested to participate?